Exclusive Access to Reliable Tax Advice That Will Save You Thousands in Taxes

Learn Strategies That Have Saved 700+ Real Estate Investors Millions in Taxes + World-Class Support From a Team of Experienced CPAs

Dear Real Estate Investor:

Congratulations on being a responsible steward of your money and searching for ways to reduce your tax bill.

Through our line of work over the years, we've gotten to know thousands of real estate investors.

Many are great at buying deals and operating real estate businesses.

But most forget that Uncle Sam is waiting to collect his share of your profits.

And that's a problem because...

Your tax bill is your single largest expense each year.

Most accountants are not tax PLANNERS

Your accountant is NOT a real estate tax specialist

- How can they know the ins and outs of real estate professional status if they only have a few landlord clients?

- How can they know where to find the short-term rental exclusion to IRC Sec. 469 if you're their only client with a beach house?

- How can they possibly know whether to capitalize and depreciate, or immediately expense the HVAC replacement on your 20-unit property if they have a small base of real estate clients?

Your accountant is busy and you speak with them infrequently

You must invest in the education and support needed to implement superior tax strategies and win battles with the IRS.

... And that's where we come in.

After working with hundreds of investors, we've learned that you don't have time to read and interpret all the technical jargon in the Tax Code to figure out tax strategies that are available to you.

But you are looking for legitimate tax strategies explained in plain English.

You do want to learn how to minimize your taxes because you know your accountant may not be prioritizing you.

And that's exactly what you'll get by becoming a Tax Smart Investor member.

What you'll get:

- An easy-to-read weekly Tax Strategy Newsletter that breaks down complex strategies into actionable insights that you can implement on your own or with the help of your accountant.

- Access to our content archives of all prior articles.

- Access to proprietary investor tools, like a bookkeeping spreadsheet and a 1031 exchange calculator.

What will you learn by Becoming a Tax Smart Investor?

Here’s what we cover in our weekly newsletter and content:

How to qualify as a real estate professional

Hours that count toward material participation

How investing in short term rentals can be extremely beneficial to your tax position

Deductions landlords can claim

Investing through your retirement accounts

How to avoid IRS audits

How to hire your spouse, and children, legally

How to deduct travel costs

How to deduct meal expenses

Bonus depreciation rules and how it can create large losses for you

What a cost segregation study is and how to implement it

Choosing the right business entity

How to use a home office and deduct the costs of it

How losses from one rental can offset income from another

Upcoming Tax Law Changes

And MUCH more!

It’s time to educate yourself on the tax strategies you should be implementing.

Click the button below to sign up for a Tax Smart Investors membership.

The Tax Strategy Newsletter will give you actionable insights that you can use to have better conversations with your own accountant.

But we write this in such a way that you can implement many of the strategies on your own.

Want More?

Access a Team of Experienced Real Estate Tax Planners

By subscribing to our Plus or Pro plans, not only will you get the Tax-Smart Newsletter and access to our archive of exclusive content, but you will also gain access to our team of experienced real estate CPAs.

The same CPAs that over 700+ of our private clients work with at our accounting firm, The Real Estate CPA!

That's right. You don't have to go it alone or wait weeks for your CPA to respond...

The Plus plan includes:

Insiders Facebook group access

Monthly Tax Smart webinar

Live Q&As

50% OFF our annual Tax and Legal Summit recordings (a $49 value)!

Schedule paid calls with our team of CPAs

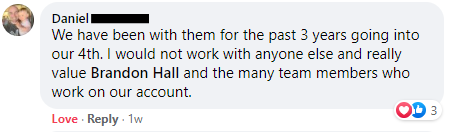

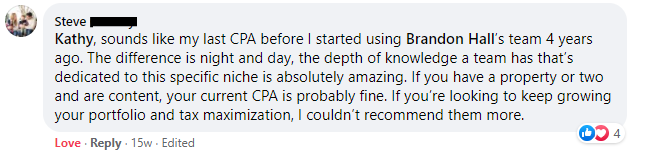

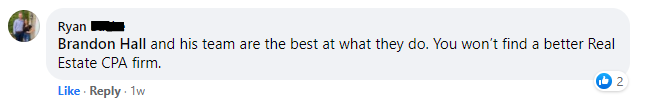

Still not convinced? Just hear what our clients and members have to say...

A Tax Smart Investor subscription is right for you if:

Your effective tax rate is more than 15%

Your CPA is not a real estate tax expert

Your CPA takes weeks to answer your emails

Your CPA provides no tax planning or advice to help you minimize your taxes

You like to stay up-to-date on the latest tax-law changes and strategies impacting real estate investors

A Tax-Smart Investor subscription may NOT be right for you if:

Your effective tax rate is less than 15%

Your CPA is a real estate tax expert

Your CPA responds to your emails promptly

Your CPA provides actionable tax planning and advice that helps reduce your taxes.

You like reading and interpreting the tax code yourself

As a real estate investor myself, I designed Tax Smart Investors to be the best place for real estate business owners and landlords to learn about tax strategies and how to implement them.

As a real estate investor myself, I designed Tax Smart Investors to be the best place for real estate business owners and landlords to learn about tax strategies and how to implement them.

We have several membership options allowing you to decide what level of support you need from our team.

Get in on the action and start saving money today.

See you on the inside.

Regards,

Brandon Hall, CPA

Chief Tax Strategist

Tax Smart Investors by The Real Estate CPA

Basic Plan

- Access Our Content Archive

- Investor Tools and Calculators

- Weekly Tax Strategy Newsletter

- Monthly Tax Smart Webinar

- Insiders FB Group

- 50% OFF Tax and Legal Summit Recordings ($49 Value)

- Schedule Paid 60-Min Tax Advisory Calls Ad Hoc ($500 ea)

- Monthly Live Q&A

Plus Plan

- Access Our Content Archive

- Investor Tools and Calculators

- Weekly Tax Strategy Newsletter

- Monthly Tax Smart Webinar

- Insiders FB Group

- 50% OFF Tax and Legal Summit Recordings ($49 Value)

- Schedule Paid 60-Min Tax Advisory Calls Ad Hoc ($500 ea)

- Monthly Live Q&A